Clinical-stage biopharmaceutical firm AC Immune SA (ACIU:NASDAQ), which develops precision medicines for a wide range of neurodegenerative diseases including Alzheimer's, today announced that "Genentech, a member of the Roche Holding AG Group (RHHBY:OTCQX), has informed the company that Lauriet, a placebo-controlled Phase 2 study evaluating the safety and efficacy of the investigational anti-tau monoclonal antibody, semorinemab, in mild-to-moderate Alzheimer's disease (AD), met one of its co-primary endpoints, ADAS-Cog11."

The firm advised that semorinemab was reported to be well tolerated but noted that the second pre-established co-primary endpoint, ADCS-ADL, was not met in the study.

AC Immune reported that in the Lauriet study, semorinemab registered a statistically significant reduction in cognitive decline from baseline by 43.6% versus the control group. The results were calculated after 49 weeks of treatment using the Alzheimer's Disease Assessment Scale, Cognitive Subscale, 11-item Version (ADAS-Cog11).

The company said that Genentech is now continuing with the open label portion of the study as planned and that it expects additional top-line data to be available in time for a presentation at the Clinical Trials on Alzheimer's Disease conference in late autumn.

AC Immune's CEO Professor Andrea Pfeifer remarked, "The top line results of the Lauriet Phase 2 clinical trial of semorinemab are remarkable in that it is the first time we have seen a therapeutic effect by a monoclonal anti-tau antibody therapy. We also are excited by the fact that this is the first time a monoclonal antibody has had a therapeutic impact on cognition in the mild-to-moderate AD patient population."

"Scientifically, these data are encouraging for the therapeutic strategies targeting tau. We look forward to additional data from our other clinical-stage tau programs: tau vaccine ACI-35, partnered with Janssen; and the small molecule Morphomer® tau aggregation inhibitor, partnered with Eli Lilly," CEO Pfeifer added.

The company explained that the Phase 2 Lauriet trial is a double-blind, randomized study of investigational anti-tau monoclonal antibody semorinemab versus placebo. The firm indicated that in the trial is being carried out in 43 study centers globally and has enrolled a total of 272 adult participants who have been diagnosed with mild-to-moderate AD.

AC Immune advised that that the study's primary endpoints are the observed change in cognition measured by the Alzheimer's Disease Assessment Scale (ADAS) from baseline at week 49 and the change in daily living activities based upon the Alzheimer's Disease Cooperative Study-Activities of Daily Living (ADCS-ADL) scale. The company reported that other secondary endpoints in the study were established to evaluate cognitive and functional measures.

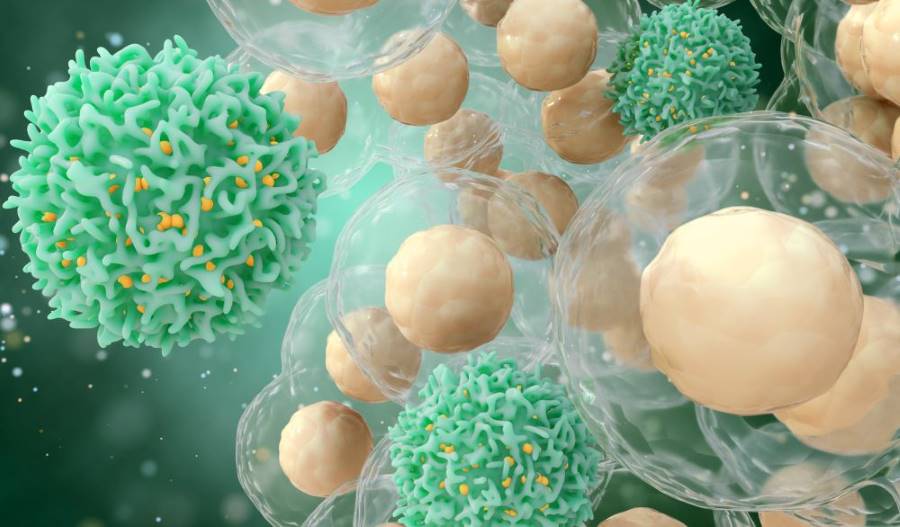

The report mentioned that semorinemab is "an investigational monoclonal anti-tau antibody that targets the N-terminal portion of the tau protein and is designed to bind to tau and slow its spread between neurons." Genentech is developing semorinemab in collaboration with AC Immune and, to date, it has been studied in two separate Phase 2 trials, the Lauriet study in mild-to-moderate AD and the Tauriel study in early (prodromal-to-mild) AD.

AC Immune is a clinical-stage biopharmaceutical firm headquartered in Lausanne, Switzerland, that concentrates its efforts on developing precision medicines to treat neurodegenerative disease such as Parkinson's disease, Alzheimer's disease, and other NeuroOrphan conditions resulting from misfolded proteins. The company's stated that "its two clinically validated technology platforms, SupraAntigen® and Morphomer®, fuel its broad and diversified pipeline of first- and best-in-class assets, which currently features 10 therapeutic and three diagnostic candidates, six of which are currently in clinical trials."

AC Immune is presently collaborating on strategic research partnerships projects with several leading global pharmaceutical companies including Eli Lilly and Co. (LLY:NYSE); Janssen Pharmaceuticals, a wholly owned subsidiary of Johnson & Johnson (JNJ:NYSE); and Roche Group's Genentech.

AC Immune started the day with a market cap of around $507.8 million with approximately 72.65 million shares outstanding and a short interest of about 1.6%. ACIU shares opened more than 70% higher today at $12.01 (+$5.02, +71.82%) over yesterday's $6.99 closing price and reached a new 52-week high price this morning of $12.61. The stock has traded today between $8.05 to $12.61 per share and is currently trading at $8.15 (+$1.16, +16.60%).

[NLINSERT]

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.