We talked to Steve Palmer, the president and chief executive officer of Toronto-based AlphaNorth Asset Management, to get his take on the coming year last fall.

As 2024 dawns, Streetwise Reports checked in with him again for his continued outlook on the coming year.

He said his "positive" outlook hasn't changed. While 2023 was challenging for some indices, including the TSX Venture, it was a positive year for large-cap indices, he said.

"But as we emerge from that, I think it's some of the lagging sectors like small cap that are going to outperform with the backdrop of rates falling. So, this year, I think that's a positive for small caps," he said.

Palmer said he sees a lot of potential for many spaces in small-cap markets to grow.

"Some of the past bull markets have been only a function of several sectors, like maybe resources only or cannabis and crypto," he said. "I think the current potential is for all sectors to really be going up at the same time, which could make for a more powerful than normal market."

AlphaNorth, founded in 2007, combines technical analysis with both bottom-up and top-down strategies when selecting investments that offer the best reward versus risk opportunities.

The firm utilizes various technical analysis techniques that have proven successful to assist in determining the timing of buy/sell decisions. Fundamental analysis, including management meetings, is also routinely employed during AlphaNorth's security selection process.

Palmer himself has been in the industry since 1995 and has many awards as a top portfolio manager. According to AlphaNorth's website, "Steve was the vice president of Canadian Equities for nine years at one of the world's largest financial institutions. The small-cap fund returned 35.8% annualized during his tenure, ranking it as the #1 fund across several time periods by a major fund ranking service." Collective Mining Ltd. (CNL:TSXV)

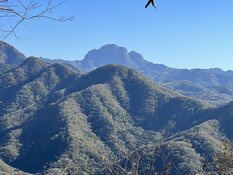

Collective Mining Ltd.

One company Palmer has talked about and is still watching is Collective Mining Ltd. (CNL:TSXV), a Canadian copper, silver, and gold exploration company that focuses on projects within Caldas, Columbia.

He first became involved with the company through one of his partners and later became impressed with their management team, members of whom worked to construct the largest gold mine in Colombia, which was sold to Zijin Mining for about CA$2 billion in 2020.

"The ex-Continental Gold team has since been reunited to form Collective Mining," the company noted on its website.

Last fall, Palmer noted that the company was "on to something very big," and he said he still thinks the company is "getting some great results for their drill program." In last year's context, that may have not been enough. "Markets in the last few months haven't really responded favorably to that. So, at some point, there's going to be some catch-up with the stock price."

Gold is now above US$2,000 so far in 2024. "It's looking to hold above US$2,000, which would be a big positive for the junior gold space. If US$2,000 becomes the floor, then we go maybe to new highs."

Gold was at US$2,049.50 on Friday afternoon.

Palmer said he believes the U.S. dollar is a key catalyst. "A weak U.S. dollar is good for gold," he said. "It's my expectation that the U.S. dollar will be weak."

Collective plans 40,000 meters of diamond drilling this year and has seen results including 519.10 meters of 2.76 grams per tonne gold equivalent (g/t Au Eq) at its Apollo mine and 136.45 meters of 1.31 g/t Au Eq at its Plutus mine.

According to Reuters, 39% of the company is held by management and insiders, and about 10% by institutions. The rest is retail.

Top shareholders include Executive Chairman of the Board Ari Sussman with 17.89%, Independent Director Ashwath Mehra with 2.17%, and CFO Paul Begin with 1.87%.

Major institutional shareholders include 1832 Asset Management LP with 5.19% and Sprott Asset Management LP with 2.92%. Char Technologies Ltd. (YES:TSX.V)

Collective Mining has a market cap of CA$245.61 million with 60.64 million shares outstanding. It trades in a 52-week range of CA$2.55 and CA$7.05.

Char Technologies Ltd.

Another company Palmer is watching is Char Technologies Ltd. (YES:TSX.V), which specializes in high-temperature pyrolysis — a process that uses heat to decompose organic materials and convert them into renewable energy and valuable carbon outputs.

Palmer said the cleantech space, like many in the TSX, is one that has corrected significantly, and Char is "one of the better" companies in the sector, in his view.

"This is one of the reasons why I'm very bullish on the market because all the sectors have basically been crushed, and sentiment is so bad," he said.

Char has received money from the Canadian government, which gave the company about CA$13 in funding, and a CA$6.6 million strategic investment by ArcelorMittal SA, the world's largest steel company by revenue.

"If they're putting in money, they're going to use the technology for their mills, which would be a huge opportunity for Char," Palmer said. "Obviously, they've done a lot of due diligence prior to putting money in. So yeah, that's one of my favorite clean tech names in the space."

Palmer said he also expects further catalysts for the company this year, including offtake agreements for the resulting natural gas and further grants and funding.

Reuters reports that about 29% of Char Technologies is held by management and insiders. CEO Andrew White has 6%, with 5.02 million shares, and Director James Sbrolla has 5.55%, with 4.64 million. 13.16% is with strategic investor ArcelorMittal SA.

The rest is with retail investors.

Char has a market cap of CA$42.87 million with 83.6 million shares outstanding. It trades in a 52-week range of CA$0.27 and CA$0.82. Volt Lithium Corp. (VLT:TSV;VLTLF:US)

Streetwise Ownership Overview*

Volt Lithium Corp. (VLT:TSV;VLTLF:US)

Volt Lithium Corp.

One sector that seems to have dominated recent discussion is lithium and the possibility of an electric future for transportation.

"There's obviously a major push around the world to electrify everything," Palmer said.

However, "a lot of the government timelines are not reasonable," he said. "There's a big demand for lithium, for the batteries. The concerning thing is the lithium price has been in freefall . . . So that's not a positive backdrop."

But there are companies to be found with upsides in the sector. Palmer said Volt Lithium Corp. (VLT:TSV;VLTLF:US) stands out for its use of direct lithium extraction (DLE), a method that uses chemical processes to speed up the process of production compared to traditional methods like brine extraction and hard rock mining.

Volt said it is aiming to be North America's first commercial producer of lithium hydroxide and lithium carbonates from oilfield brine. Recently, it released its Preliminary Economic Assessment (PEA) of its 430,000-acre Rainbow Lake lithium project in Alberta.

The reservoir there is estimated to have 99 billion barrels of lithium-infused brine with concentrations up to 121 mg/L, and the company said its proprietary DLE technology is giving recoveries of up to 90%.

"This is something that can be brought online very quickly compared to other lithium projects," Palmer said.

Management and insiders own approximately 16.48% of VOLT. President and CEO James Alexander Wylie owns 8.73%, Director Martin Scase owns 4.94%, Director Warner Uhl owns 0.75%, CFO Morgan Tiernan owns 0.39%, Director Maury Dumba owns 0.49%, and Director Kyle Robert Hookey owns 1.18%.

Reuters reported that institutions own 1.01% of the company with 1 million shares in the form of U.S. Global Investors, Inc.

There are 130.3 million shares outstanding, with 110.4 million free float traded shares. The company has a market cap of CA$32.23 million and trades in a 52-week range of CA$0.09 and CA$0.55. Byrna Technologies (BYRN:NASDAQ)

Byrna Technologies

Another company Palmer discussed was Byrna Technologies (BYRN:NASDAQ), which is working to provide civilians, law enforcement, and security workers with safe non-lethal alternatives to firearms. Byrna has a current line of "less-lethal" pistols which use compressed air (CO2) to stop an attacker in their tracks.

The weapons require no background checks or waiting periods.

The company has recently turned to celebrities, including Sean Hannity, to endorse its products. The results have been extraordinary. According to the company, preliminary unaudited results show that revenues in Q4 2023 jumped 120% over Q3 2023 to US$15.6 million.

"This is one of those stories where the numbers kind of speak for themselves," Palmer said.

Reuters notes that 20% of the company is held by management and insiders. Pierre F. Lapeyre, Jr. owns the most shares in this category at 13.16%, with 2.89 million shares.

About 25% is with institutions. ArrowMark Colorado Holdings LLC has 7.33%, with 1.61 million. The Vangaurd Group Inc. has 3.53%, with 0.78 million, and FNY Investment Advisors LLC has 3.41%, with 0.56 million.

The rest is with retail investors. Delcath Systems, Inc. (DCTH:NASDAQ)

Byrna has a market cap of US$127.47 million and 21.98 million shares outstanding. It trades in a 52-week range of US$2.19 and US$10.38.

Delcath Systems Inc.

Palmer also discussed a biotech company that has been on his radar, Delcath Systems, Inc. (DCTH:NASDAQ).

The company is focused on the treatment of primary and metastatic cancers of the liver and announced in August that the U.S. Food and Drug Administration (FDA) approved its HEPZATO KIT (melphalan/Hepatic Delivery System) as a liver-directed treatment for adult patients with metastatic uveal melanoma (mUM).

The rare and aggressive form of metastatic cancer has a U.S. incidence of about 1,000 cases per year, the company said.

90% of the disease involves the liver, and liver failure is often the cause of death.

While the stock spiked 70% to US$5.67 per share after the FDA announcement, it quickly started sinking, going as low as US$2.25 on November 13.

The stock was US$4.11 on Friday afternoon.

"It makes no sense that you can have a successful trial and FDA approval, and the stock goes down," Palmer said. "So that's a bizarre situation. But that includes lots of upside. It's on its way back up and it's now over US$4. I expect it will be a US$20 stock at some point."

According to Reuters, about 3% of the company is held by management and insiders and about 37% by institutions. The rest is retail.

Top shareholders include Vivo Capital LLC with 8.42%, Logos Global Management LLC with 4.74%, Rosalind Advisors Inc. with 4.71%, BVF Partners LP with 4.43%, and Point72 Asset Management with 3.26%.

Delcath has a market cap of US$90.56 million with about 22 million shares outstanding. It trades in a 52-week range of US$7.99 and US$2.25.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese, Biotechnology / Pharmaceuticals, Silver, Battery Metals, Gold, Technology and Alternative - Cleantech investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Volt Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Char Technologies Ltd. and Volt Lithium Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Further Disclosure for AlphaNorth: AlphaNorth may own the companies mentioned in this report.