The Life Sciences Report: Colin, it's been two years since Japan revised the Pharmaceutical Affairs Act, which allows for conditional approval of regenerative medicine products after Phase 1 or 2 studies. Can you tell us a little bit about how this has transformed regenerative medicine in Japan?

Colin Lee Novick: The revised Pharmaceutical Affairs Act, which is referred to as the PMD Act for short, created an entirely new pharmaceutical subcategory called regenerative medicine products; a term which encompasses cell therapies, gene therapies and tissue-engineered products in Japan.

"The Regeneus Ltd.-Asahi Glass deal is nicely designed; RGS gets the upfront payments and the milestone payments from AGC, but it also gets a portion of subsequent milestone payments and upfront payments from any pharmaceutical company that it teams up with for the commercialization rights."

If a company's product can be classified as a regenerative medicine product, it can potentially qualify for conditional approval; a system whereby the company can receive up to seven years of conditional approved sales and manufacturing of the product after early-stage trials that prove the safety and provide probable efficacy, as long it can also be classified as a cellular heterogeneous product. The last portion is an oft-forgotten but important part of the revised law. Also important is the 70% government reimbursement for therapies that have been approved, conditionally or otherwise.

That blew open a route to market that hadn't really existed anywhere in the world. If you talk to the Pharmaceuticals and Medical Devices Agency (PMDA), the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), they'll all be very diplomatic about saying how each jurisdiction already has their own version of conditional approval; it's just whether or not it's phrased that way. For instance, they will point out that in the U.S. they already have fast-track designation and that this is, in a way, analogous to Japan's conditional approval.

However, in my opinion, the Japanese conditional approval is much more of a transformational change. In Japan they highlight the fact that the new route to approval is for regenerative medicine. Regenerative medicine encompasses three types of products: cellular therapies, gene therapies and tissue engineering.

Japan was able to take the market by storm through providing an easier-to-understand regenerative medicine pathway to market than Europe, which actually had passed an advanced therapy medicinal products (ATMP) European Commission law much earlier than Japan. Unfortunately, the European route was convoluted and it was difficult to follow for those who were not already well acquainted with Europe. All of a sudden Japan, which, on a countrywide basis, is the second largest pharmaceutical market on the face of the planet, had the government's and regulators' backing, pushing to get the country to the forefront of the regenerative medicine space. It propelled Japan as a focal point for the development of clinical trials and regenerative medicine.

It's been a boon for the industry. There have been many deals, both domestic and nondomestic, focusing on Japan.

TLSR: Before we get to those deals, could you talk a little bit about what's going on in the United States? Has the 21st Century Cures Act passed in December made things easier for U.S. regenerative medicine companies?

CN: Let me start by providing a little more background. As I mentioned earlier, of the three major pharmaceutical jurisdictions on the global pharmaceutical market, the U.S., Europe and Japan, Europe moved first, in 2007, in setting up a regulatory pathway and a law that has a subsection for regenerative medicine. The regulation provided a detailed explanation as to what falls under the advanced therapy medicinal products (ATMP) category: tissue-engineered products, somatic cell therapy medicinal products and gene therapy medicinal products.

While this regulation did have a galvanizing effect on cell therapy and gene therapy development and European countries did start off a little bit faster than the U.S. and Japan, the law was also difficult to understand. So it kick-started it, but then it kind of stuttered a little bit.

Then Japan passed its laws and mimicked the actual product characterization as tissue engineering, cell therapies and gene therapies, and added its own little flavor by providing a relatively easier-to-understand route to market called conditional approval. All of a sudden, Japan was able to steal some of Europe's thunder.

The U.S., on the other hand, for a long time has been in a situation whereby, at least regulatorily speaking, it was considered to be well behind Europe and especially far behind Japan; oddly it found itself in a position that it had never really been in heretofore. The U.S. had always been a regulatory leader.

In the 21st Century Cures Act, Section 3033 is the Accelerated Approval for Regenerative Medicine Advanced Therapies. So the U.S. now has, just like Japan, an accelerated approval process for regenerative medicine.

But unlike Japan, where a company can potentially pursue an accelerated approval for anything as long as it can prove that the product is safe, has probable efficacy and is cellular heterogeneous, regenerative advanced therapy in the U.S. needs to "facilitate an efficient development program and expedite review of such drug. A drug is eligible for designation as a regenerative advanced therapy under this subsection A) if the drug is a regenerative medicine therapy, B) if the drug is intended to treat, modify, reverse or cure a serious or life-threatening disease or condition." That's the big difference: It has to be serious or life threatening.

Developing some sort of musculoskeletal or dermatological product will help a lot of people, but it's not going to be accelerated. If you have rheumatoid arthritis (RA), the biologics right now work for that, and it's not a life threatening condition. So you're probably not going to get the accelerated designation. If a company is developing, for instance, a congenital heart failure (CHF) product or an acute myocardial infarction product for diseases with high mortality rates, these can get the designation.

From a Japan and a Europe perspective, the 21st Century Cures Act hasn't really affected the market yet. It's too early. There hasn't been a significant moving away from Japan now that the U.S. has this new system.

TLSR: Would you talk about what is actually happening in Japan—mergers, licensing deals, contract manufacturing tie-ups, etc.?

CN: We can classify the types of deals in Japan into three major categories. The first category is cellular manufacturing deals or contract manufacturing organization (CMO) deals. These are categorized by some of the major players in cellular manufacturing teaming up with some major Japanese corporate conglomerates that are looking to pivot into pharmaceutical manufacturing.

Examples are the Lonza Group AG (LONN:SIX; LO3:FSE; LZAGF:OTCPK)-Nikon Corp. (7731:TYO) deal that everyone's talking about that was signed in May 2015. Also, in March of last year, PCT, a subsidiary of Caladrius Biosciences Inc. (CLBS:NASDAQ) signed a deal with Hitachi Chemical Co. Ltd. (4217:TYO).

Those are both instances where a cellular contract manufacturing organization outside of Japan is licensing its know-how to a large company in Japan that has no experience in contract manufacturing, like Nikon and Hitachi.

Very recently, a third behemoth showed up on the scene for CMOs, and that is a deal between an Australian biotech called Regeneus Ltd. (RGS:ASX) and a very large Japanese corporate conglomerate called Asahi Glass Co. Ltd. (5201:TYO) (AGC). Now, the name doesn't really spell it out for you, but AGC is Japan's largest biologics CMO. AGC is basically saying it would like to expand its CMO offerings from a simple biologics manufacturing capacity to regenerative medicine.

AGC, over just the last six months, has acquired a German biologic CMO called Biomeva GmbH and a very large Danish CMO that does monoclonal antibodies called CMC Biologics A/S. It followed that up very quickly with this deal with Regeneus.

The Regeneus deal, compared to the CMC one, is small, but for a company of Asahi Glass' caliber to come out and say, "We're going to enter into the regenerative medicine space now," is highly indicative of the potential seen by the firm in the space. Also it highlights that when one looks to Japan, the usual suspects that are the pharmaceutical companies are not the only places to look; that's one thing that Regeneus was able to do.

TLSR: Could you tell us about the Regeneus deal?

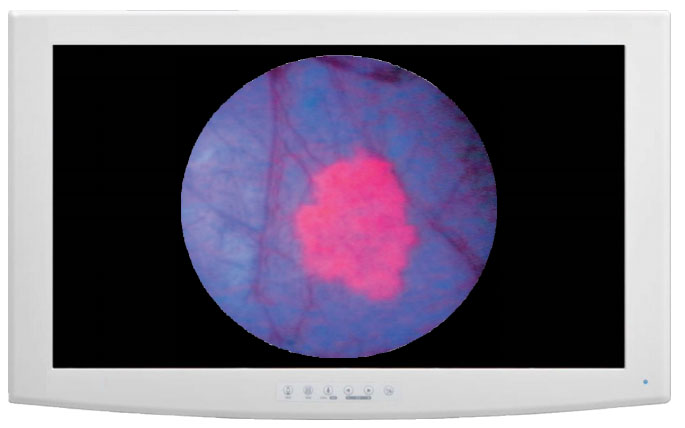

CN: Regeneus is developing a number of products, and one of its lead product platforms is called Progenza. It's an allogeneic mesenchymal stem cell product platform that has a patented differentiating factor from its competitors by adding back in the secretions, the anti-inflammatory cytokine and chemokine and growth factors that the cells secrete just by being wherever they happen to be.

By adding these back into the Progenza cells and then freezing them down, the secretions help the cell functionality. A Phase 1 clinical trial is currently being conducted. The hypothesis is that the secretions help the product be even more efficacious. Of course, it also helps that Regeneus has a patented process of combining cell secretions with their cells.

Rights to any product in any jurisdiction are divided into three subcategories—the rights to manufacture the product, the rights to develop the product and the rights to sell the product. Generally companies will license all three out in to a single company, or a company will retain the manufacturing rights and license out the development and marketing rights.

Regeneus licensed to AGC the right to manufacture Progenza for Japan; for that, AGC is paying US$5.5M up front and an additional US$11M in specified milestones, one or two of which will likely come within 12 to 18 months.

Another part of this deal that Regeneus and Asahi Glass signed was the formation of a subsidiary, 50% owned by each of the companies. This company will allow both involved companies to have a say in who the marketing partner for Progenza will be in Japan.

Asahi Glass and Regeneus will now cooperate to find a pharmaceutical partner in Japan to sublicense out the marketing and development rights for Progenza in Japan. Regeneus now has a very large Japanese company that is well known by Japanese pharmaceutical companies because they outsource to AGC on a regular basis. So Japanese pharma companies will be able to deal with Regeneus alongside a face that they recognize. This should help immensely in further negotiations with potential marketing partners.

This is a nicely designed deal. Regeneus gets the upfront payments and the milestone payments from AGC, but it also gets a portion of subsequent milestone payments and upfront payments from any pharmaceutical company that it teams up with for the commercialization rights. And the pharmaceutical company gets the added benefit and reassurance that its product is going to be manufactured by a Japanese company that the PMDA, the regulator of Japan, is very used to. So keep an eye out for Regeneus over the next 12 to 18 months for assigning a marketing partner.

I should add that last year AGC announced its midterm growth strategy called Vision 2025. Within that, AGC designated the life sciences sector as a strategic growth business. It said that within the next five years it has a budget of 1.3 trillion Japanese yen (1.3T JPY) that it has set aside to grow these strategic businesses; that figure is divided into 1T JPY for investments and R&D and 300B JPY for mergers and acquisitions (M&A). So for the M&A portion, it has already done the CMC Biologics and the Biomeva acquisitions. The Regeneus play was part of that 1T for investments and R&D.

I think it's good for the industry that Japan now has AGC, Hitachi and Nikon, which are three corporate behemoths in Japan, all saying, "We're going to get involved in this industry." Each one offers a slightly different value proposition. Hitachi and Nikon have Lonza and PCT, which are experienced in cellular therapies, backing them up, and that's how they are going to ramp up the learning curve. AGC knows how to do contract manufacturing with biologics. It needs to modify this knowhow to cellular manufacturing.

TLSR: Okay, let's move on to licensing deals. What's going on in Japan?

CN: Back in 2013, before the Japanese regenerative medicine laws were promulgated, RepliCel Life Sciences Inc. (RP:TSX.V; REPCF:OTCQB) and Shiseido Company Ltd. (4911:TYO) signed a deal for Replicel's RCH-01 product, which is for androgenic alopecia or male pattern baldness. Shiseido is taking the RCH-01 product down the Act on the Safety of Regenerative Medicine (ASRM) route to market, as they see immense market potential to offer the treatment as quickly as possible to men who suffer from pattern baldness. The ASRM route to market does not come with the coveted Japanese NHI insurance coverage, but the indication is one that doesn’t necessarily need the NHI insurance coverage incentive to work.

"I would keep my eyes peeled on RepliCel Life Sciences Inc. and Shiseido in the coming months for indications as to when the male pattern baldness therapy will become available in Japan."

Shiseido already has opened the Shiseido Cell-Processing and Expansion Center (SPEC) in Kobe and is using this location as its base to develop and eventually provide the therapy. Not many non-Japanese companies understand the ASRM route to market but it is one that a relatively well-known regenerative medicine company, Cytori Therapeutics Inc. (CYTX:NASDAQ), has already received multiple approvals for over the years and is a very real and relatively fast route to market that exists in Japan. I would keep my eyes peeled on RepliCel and Shiseido in the coming months, too, for indications as to when the therapy will become available in Japan.

In 2014, another deal was done between two Japanese companies, SanBio Co. Ltd. (4592:TYO) and Sumitomo Dainippon Pharma Co. Ltd. (4506:TYP; DNPUF:OTCPK) for the SB-623 product, and this was for stroke.

Once we got to 2015 and 2016, we started to see a whole host, especially in 2016, of deals being brought to the table. There were two deals for Athersys Inc. (ATHX:NASDAQ). First, it signed with Chugai Pharmaceutical Co. Ltd. (4519:TYO) for MultiStem for ischemic stroke in Japan. Soon after, Chugai actually dropped that deal, but it was quickly picked up in January 2016 by Healios KK (4593:TYO), Dr. Tadahisa "Hardy" Kagimoto's company.

Celixir, known as Cell Therapy at the time of the deal, a privately held Welsh company, signed up with Daiichi Sankyo Co. (4568:TYO; DSKYF:OTCPK) last May, for Heartcel, which is for CHF.

TiGenix NV (TIG:NYX) and Takeda Pharmaceutical Co. Ltd. (TKPYY:OTCMKTS; 4502:TYO) linked up in July of last year for Cx601 for perianal fistulas as part of a Crohn's disease treatment.

Celyad (CYAD:NASDAQ; CYAD:BR) and Ono Pharmaceutical Co. Ltd. (OPHLF:OTC; 4528:Tokyo) announced a license agreement in July 2016 for NKR-2 T-cell cancer immunotherapy treatment.

Mitsubishi Tanabe Pharma Corp. (4508:Tokyo) and Kolon Life Science Inc. (102940:KOSDAQ) announced a licensing and development agreement for its Invossa product for degenerative osteoarthritis in November 2016.

Also in November, Taiwan-based Steminent Biotherapeutics Inc. and ReproCELL Inc. (TYO:4978) announced a partnership in Japan for Stemchymal, a treatment for spinocerebellar ataxia, a very niche indication.

In December, Pluristem Therapeutics Inc. (PSTI:NASDAQ) and Sosei CVC Ltd., which is backed by Sosei Group Corporation (4565:TKY), announced a venture in December for PLX-PAD in Japan for critical limb ischemia.They haven't released all the details of the contract, but are forming a joint venture.

Just on Jan. 9, Kite Pharma (KITE:NASDAQ) and Daiichi Sankyo signed a deal for KTE-C19. That's a chimeric antigen receptor T-cell (CAR-T) therapy to target lymphoma and leukemia cancer cells.

These are all within the past year. Upfront payments can run from US$5M up to US$50M, with the total potential amounts running from the low-US$200M all the way up to US$413M if they involve the commercialization licenses. These are big deals; a lot of them are also Japan-specific. Generally speaking, these are indication-specific and jurisdiction-specific licensing deals with smaller, non-Japanese biotechs—of course with the exception of SanBio, which is a Japanese biotech—licensing out to larger Japanese pharmaceutical companies or a subsidiary that is related to those larger Japanese pharmaceutical companies.

TLSR: And what is happening on the M&A front?

CN: There are outright buyouts. Fujifilm Holdings Corp. (4901:TYO) acquired Cellular Dynamics International Inc. back in 2015 for around US$307M.

And then Astellas Pharma Inc. (ALPMF:OTCPK; 4503:TYO) acquired Ocata Therapeutics Inc. in February 2016 in a drawn-out process that took a few extra months. But it ended up buying Ocata for around US$380M+. Astellas renamed Ocata the Astellas Institute for Regenerative Medicine (AIRM) in May 2016.

There's this ripe atmosphere in Japan right now for companies to come here, find a potential partner and do business. Investors, and of course the companies themselves, just need to understand that setting up a deal in Japan often takes a long time.

Japanese shareholders of Tokyo Stock Exchange companies think a lot longer term than Western shareholders, so Japanese companies don't usually feel the same sort of pressure of missing deadline by a few months for signing a deal.

If a company doing business in Japan happens to miss a deadline or a deal gets pushed out by a month or two, investors need to think of this as a Japanese deal, that it's not the end of the world and take it in stride.

TLSR: Do you think we're going to see a lot more of licensing deals, buyouts and CMOs, or have we reached a plateau?

CN: I think CMOs are probably plateauing. Any new CMO is going to have to realize that it's coming up against Nikon, Hitachi and Asahi Glass. That's a lot of capital for other companies to compete with. These companies can throw up a new manufacturing plant very quickly.

Smaller players will be coming online. Off the top of my head, I know around 10 players that are already there. But the big three are probably going to start cornering the market at some point.

For licensing deals, I think that there definitely are a lot more deals lying in wait, starting with the Regeneus deal.

Another Australian company, Cynata Therapeutics Ltd. (CYP:ASX), signed an agreement to work toward a definitive agreement with Fujifilm for its iPS cell-derived MSC technology, CYP-001. It said that it was going to get some sort of a deal out by the end of December, but as I said earlier, I don't want the markets to lose faith that it wasn't able to get the deal done by the end of December. This is a Japanese deal. It's going to miss that deadline 9 times out of 10. So I'd keep an eye on it. (In the days following this interview, Cynata was able to finalize its deal with FujiFilm.)

I know of a number of other companies as well that are actively talking and searching for partners. These are both large and smaller companies in the biotech sphere, so basically everybody that has some sort of interesting data.

Another interesting company that you should probably keep an eye out on is Asterias Biotherapeutics Inc. (AST:NYSE.MKT). Earlier I said Astellas bought out an embryonic stem (ES) cell company called Ocata Therapeutics. A Ministry of Education, Culture, Sports, Science and Technology (MEXT) document talks about embryonic stem cell therapies and highlights three companies whose ES cell products adhere to the Japanese guidelines. The first of those three companies is Ocata Therapeutics, and Astellas has already bought it out.

The second one is Asterias. Asterias was, I believe, the very first company that did an embryonic stem cell trial. It has tons of data. It is running a clinical trial right now for spinal cord injury, which has been a problematic indication for many years because there's really nothing that has been developed that actually seems to work. And it's getting some exciting information that is definitely worth a closer look. I would keep the company on the radar.

Finally, I would be remiss if I didn't mention I'rom Group Co. Ltd. (2372:TYO). I'rom was founded in the mid-1990s to provide clinical trials support for physicians and hospitals. It expanded into the clinical research organization (CRO) business and then to medical mall development, while keeping an eye on a Japanese government regenerative medicine project that eventually became ID Pharma Co. Ltd. ID Pharma's primary platform technology is an RNA Sendai viral vector. Unlike DVA vectors, RNA vectors do not pose the risk of integration with the host's DNA.

Over the past year or so ID Pharma, and I'rom, have teamed up with Stanford's Medicine X to take a closer look at the Sendai viral vector and have furthered their collaboration with Kyushu University, which is proceeding with an investigator-initiated Phase 2b study on ID Pharma's lead product candidate for critical limb ischemia. The company has also commenced a Phase 1/2a study in Adelaide, Australia, last year as well.

TLSR: Before you go, any parting thoughts?

CN: If you're on the investor side and you're wondering what sort of a company would be worthwhile investing in the long term, a strong Japan story is a positive. Japan has the most well-defined regulatory system and the easiest to understand regulatory pathway. If you're a biotech and you're not already looking toward Japan, you're missing a golden opportunity.

I want to highlight that, at least for now, the larger Japanese pharmaceutical companies seem to be leaning toward allogeneic therapies. There seems to be preference toward platform technologies, so not a single indication but some sort of technology that enables the company to go in multiple directions should one direction happen to fail.

And then finally—I cannot stress this enough—deals in Japan take longer than they do in the U.S. It's not going to happen overnight unless you are very lucky.

TLSR: Thank you, Colin, for your insights.

Colin Lee Novick is cofounder and managing director of CJ PARTNERS. As an American born in South Korea and raised in Japan, Novick graduated from Japanese public schools to study at Cornell University. After working as a management consultant at Deloitte Tohmatsu Consulting within the Financial Services Industry Group for three years, Novick sought out a new industry at SMBC Nikko Securities, where he facilitated mergers and acquisitions. In 2012, Novick and cross-cultural colleague Jason David Sieger founded CJ PARTNERS Inc. to assist in Japan Inc.'s development.

Read what other experts are saying about:

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are sponsors of Streetwise Reports: Regeneus Ltd. and RepliCel Life Sciences Inc. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclaimers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Colin Lee Novick: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this interview: Regeneus Ltd., Asterias Biotherapeutics Inc., and I'rom Group Co. Ltd. Furthermore, I'rom Group also owns 22.22% of CJ PARTNERS Inc. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.