It's always rough to have to report a drop in the value of the Small-Cap Biotech Watchlist. As of May 8, 2015, the Watchlist was posting a return of -16%. The decline is reflective of the slams taken by the stock of two companies after they missed endpoints in clinical trials.

It also reflects a springtime check on the biotech market's ongoing bull run. As BioCentury senior editor Steve Edelson wrote on May 4, analysts noted the recent "6% hosing of biotech indices reflects generalist investors exiting the sector." Small-cap biotechs, like those on the Watchlist, have been the hardest hit. In addition, analysts who spoke with BioCentury believe the drop was a "temporary decline that would likely serve to set a new base for continued growth."

2015 Small-Cap Biotech Watchlist Portfolio Tracker

The Life Sciences Report reviewed the stock performance of each company year-to-date as posted by Yahoo Finance as of Friday, May 8. We have also posted the comments of analysts George Zavoico of JonesTrading International Services and Reni Benjamin of H.C. Wainwright & Co. on the companies they selected for the Watchlist. Here are the highlights:

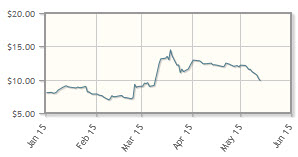

Applied Genetic Technologies Corp. (AGTC:NASDAQ)

The company, which is developing genetic therapies for wet age-related macular degeneration and rare eye diseases, has posted a 13% loss year-to-date.

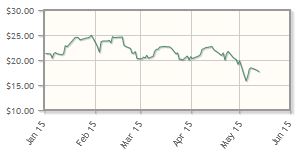

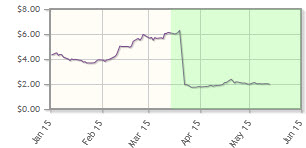

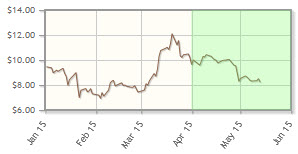

Can-Fite BioPharma Ltd. (CANF:NYSE.MKT)

The company, which focuses on cancer and autoimmune disease, has posted a 33% loss year-to-date, but the stock bounced up at the end of April.

Analyst comment: "The stock started the year around $3.50/share and reached a high of $5.50/share before the company released negative Phase 2/3 data. Subsequent analysis of the data shows promise in a certain subset of patients. Given the side-effect profile and efficacy seen to date, and the potential to secure a partner to help in the clinical development of the drug, we believe the company could reach our new target price of $4/share within the next 12 months." Reni Benjamin, H.C. Wainwright & Co.

The company, which focuses on hematologic malignancies, has posted a 22% loss year-to-date. CTI announced positive results for its Phase 3 PERSIST-1 trial of pacritinib in myelofibrosis in March.

Lion Biotechnologies (LBIO:OTCBB)

The company, which is developing immunotherapeutic treatments targeting metastatic melanoma and solid tumors, has posted a 43% increase year-to-date. Lion announced positive results in two studies, one in melanoma and the other in metastatic cervical cancer, in March and April, respectively.

The company, which is developing cancer treatments via several inhibitors, has posted a 52% loss year-to-date. In March, MEI announced its candidate, pracinostat, didn't meet the primary endpoint in a Phase 2 clinical study.

OncoSec Medical Inc. (ONCS:OTCBB)

The company, which is developing electroporation technologies targeting skin cancers, is down 39% year-to-date.

Analyst comment: "The stock has been on a down-trend since the beginning of the year. Given the continued excitement in the checkpoint inhibitor space and the positive panel meeting surrounding T-Vec (Amgen Inc.'s intra-tumoral therapeutic), we continue to believe that OncoSec is making great strides. We believe the stock will turn around going into the second half of the year in anticipation of combination data with checkpoint inhibitors being made available." Reni Benjamin, H.C. Wainwright & Co.

Oncothyreon Inc. (ONTY:NASDAQ)

The company, which is developing cancer treatments using small molecules and immunotherapies, is down 14% year-to-date.

Analyst comment: "The stock has been relatively flat since January. However, given the recent acquisition of Alpine Biosciences, with the potential to broaden the company's platform of homegrown therapeutics, as well as the partnering potential surrounding an active HER-2 inhibitor with the ability to penetrate the blood-brain barrier and a differentiated side-effect profile, we believe shares are likely to increase going into the 2015 American Society of Clinical Oncology (ASCO) meeting. Over the longer term, we expect the company to announce several partnerships surrounding the company's drug delivery platform." Reni Benjamin, H.C. Wainwright & Co.

Paratek Pharmaceuticals Inc. (PRTK:NASDAQ)

The company, which is developing new antibiotics, is down 29% year-to-date.

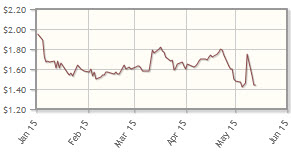

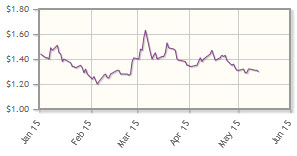

Peregrine Pharmaceuticals Inc. (PPHM:NASDAQ)

The company, which is developing monoclonal antibodies to treat cancer, is down 5% year-to-date.

Analyst comment: "Peregrine stock started 2015 by trading in a narrow $1.40-1.50/share range, then it swung to a low of $1.20/share in early February and to a high of $1.63/share in early March before ending the quarter trading in just about the same narrow range that it started the year. Key value-driving events are expected in June and in the second half of this year. Underscoring a growing appreciation that its leading drug candidate, an anti-phosphatidylserine antibody called bavituximab, is an immune checkpoint inhibitor, in the first quarter Peregrine announced positive supporting Phase 2 trial data that showed promising time-to-disease progression, disease-specific survival, and disease control rate in patients with advanced liver cancer when bavituximab was used in combination with sorafenib (Nexavar).

"Peregrine also announced that in preclinical studies, bavituximab enhanced the antitumor activity of certain immune checkpoint inhibitors, specifically anti-PD-1 and anti-CTLA-4 antibodies, in models of breast cancer and melanoma. Additional supporting preclinical data showing that bavituximab can stimulate an immune response against tumors by activating tumor-infiltrating CD8+ T cells, as well as enhance the antitumor activity of an anti-PD1 antibody, were presented in April at the American Association of Cancer Research (AACR) annual conference. At the upcoming ASCO conference, Peregrine will present further results of the Phase 1/2 trial of bavituximab in combination with sorafenib in advanced liver cancer. Peregrine has also scheduled a panel discussion, "The Next Wave of Immune Modulating Checkpoint Inhibitors," with notable key opinion leaders at ASCO on May 31.

"The company also guided to full enrollment by year-end of its pivotal Phase 3 SUNRISE trial of bavituximab in combination with docetaxel as second-line treatment of non-small cell lung cancer. An event-driven interim safety look at this trial could also occur this year. Meanwhile, investigator-sponsored Phase 1 trials of bavituximab in combination with radiation and capecitabine in rectal cancer and with ipilimumab (Yervoy) in advanced melanoma continue to enroll patients." George Zavoico, JonesTrading International Services

Sunesis Pharmaceuticals Inc. (SNSS:NASDAQ)

The company, which is developing cancer therapies targeting solid tumors and blood cancers, is down 17% year-to-date.

Analyst comment: "Sunesis Pharmaceuticals is targeting its formal meeting with the FDA in mid-2015 and, if successful, a rolling new drug application (NDA) submission in H2/15 based on fast-track status. In the European Union, the company has been assigned rapporteurs and plans to meet with the European Medicines Agency in mid-2015 to discuss its marketing authorization application filing. . .we maintain our Buy rating." Joe Pantginis, ROTH Capital Partners

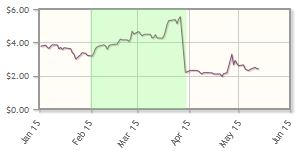

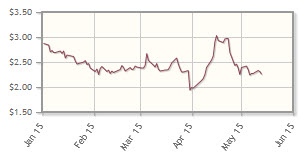

Synta Pharmaceuticals Corp. (SNTA:NASDAQ)

The company, focused on inhibition of molecular chaperones in cancer, is down 14% year-to-date.

Analyst comment: "After trading between $2.25/share and $2.87/share in the first quarter, Synta's stock price dipped briefly to a low of $1.94/share on March 31, on the coattails of a discounted ($1.75/share) financing that raised about $44.3 million ($44.3M). Subsequently, the stock price recovered and reached a year-high of $3.10/share in mid-April, most likely on the realization that the company now has the capital to complete its ongoing pivotal Phase 3 GALAXY-2 trial of its heat shock protein-90 (Hsp90) inhibitor, ganetespib, in combination with docetaxel as second-line therapy of advanced non-small cell cancer.

"In what may be Synta's most impactful milestone this year, the company guided to the possibility that the first event-driven interim overall survival (OS) analysis of GALAXY-2 could occur in the second half of this year (and a second look in 2016). In addition, two Phase 3 trials of ganetespib in combination with chemotherapy as front-line treatment of newly diagnosed elderly patients with acute myeloid leukemia (AML) or high-risk myelodysplastic syndrome (MDS) will both have commenced by midyear. A randomized Phase 2 trial, called GANNET53, of ganetespib in combination with paclitaxel for the treatment of ovarian cancer is also expected to commence before mid-year.

"At ASCO in June, results of three Phase 1 trials of ganetespib, including the Phase 1 portion of GANNET53, are expected to be presented. Synta also announced that it advanced its first Hsp90 inhibitor drug conjugate, STA-12-8666, into investigational new drug (IND)-enabling studies, with an IND filing expected in early 2016. At AACR in April, Synta presented promising results of several preclinical studies of ganetespib and STA-12-8666. In a surprise development, on April 27, Synta's recently named CEO, Anne Whitaker, stepped down to pursue an opportunity at a large multinational pharmaceutical company. Chen Schor, Synta's executive vice president and CEO, was named president, CEO, and director. The announcement had little effect on Synta's stock price." George Zavoico, JonesTrading International Services

TG Therapeutics Inc. (TGTX:NASDAQ)

The company, developing cancer treatments using monoclonal antibodies and checkpoint inhibitors, is down 6% year-to-date. TG Therapeutics announced presentation of preclinical data demonstrating the activity of its IRAK4 inhibitors in April.

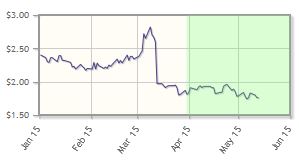

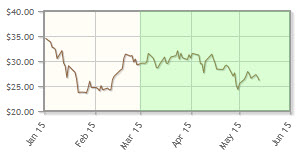

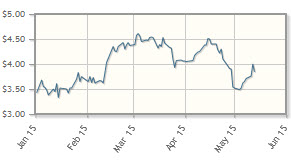

Threshold Pharmaceuticals Inc. (THLD:NASDAQ)

The company, which is working on the induction of hypoxia in a variety of solid tumors and hematological cancers, is up 16% year-to-date.

Analyst comment: "Threshold started the year trading in a range of $3.33–3.83/share, then peaked at $4.61/share in early March following a capital raise of about $28M at the market price (with warrants). It settled back into a trading range of about $4.05–4.51/share in April. Subsequently, on no news, the stock fell to about $3.50/share per share, despite the company hosting an Analyst & Investor Day on April 24.

"While no new clinical trial results of Threshold's hypoxia-activated prodrug, evofosfamide (formerly TH-302), were reported in the first quarter, we expect top-line results from the company's two pivotal Phase 3 trials of evofosfamide, in combination with doxorubicin, for the front-line treatment of advanced sarcoma, and in combination with gemcitabine for the front-line treatment of advanced pancreatic cancer, to be announced in late 2015 or early 2016. Both trials completed patient recruitment, and both are being conducted under a special protocol assessment (SPA) from the FDA. These announcements will be key milestones, and if the results are positive, they will set the stage for Threshold to transition into a commercial company.

"In addition, a large, potentially pivotal, Phase 2b trial of evofosfamide in combination with pemetrexed as second-line therapy in non-small cell lung cancer is expected to complete recruitment in early 2016. At ASCO, additional results from substantially more patients treated in a Phase 2 trial of evofosfamide, in combination with bortezomib (Velcade) and low-dose dexamethasone for the treatment of relapsed or refractory multiple myeloma, are expected to be reported.

"For the remainder of 2015, Threshold will continue to enroll patients in several other earlier-stage trials, and we expect the company to commence one or two more trials of evofosfamide.

"Finally, Threshold guided to commencing two Phase 2 trials of its second drug candidate, TH-4000, a hypoxia-activated prodrug that is a selective and irreversible inhibitor of EGFR. One trial will enroll patients with head-and-neck cancer, a cancer with large areas of hypoxia and that typically overexpresses EGFR, and the other in patients with EGFR+ non-small cell lung cancer that do not carry the T790M mutation. Persistent EGFR signaling is thought to contribute to disease progression in both of these indications. Notably, with limited Phase 1 results, both trials are designed to demonstrate proof-of-concept quickly since they have go/no-go triggers that will permit patient recruitment to continue only if a predetermined response rate is observed early in the trial." George Zavoico, JonesTrading International Services

The company, focused on inhibition of cancer stem cell pathways, is down 9% year-to-date. The company announced in February that it had received orphan drug designation for VS-5584 for the treatment of mesothelioma.

The Approval Process in Action Infographic

Original 2015 Small-Cap Biotech Watchlist Story

Read what other experts are saying about:

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Staff compiled this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as employees. They own, or their families own, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Can-Fire BioPharma Ltd., Sunesis Pharmaceuticals Inc. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) George Zavoico: I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I am responsible for the content of my comments included in the interview.

4) Reni Benjamin: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: Can-Fite BioPhaarma Ltd., OncoSec Medical Inc. and Oncothyreon Inc. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.