The Life Sciences Report: Ed, you organized the H.C. Wainwright inaugural NASH (nonalcoholic steatohepatitis) Investor Conference with several key opinion leaders (KOLs) and presentations by 16 companies. What are the medical needs of patients with NASH? What is the market potential of drugs to treat NASH?

Ed Arce: It was the first conference for investors specifically on NASH, so we were pretty excited to have all of the companies join us as well as several of the KOLs in the space.

NASH is very closely tied to the longstanding global epidemic that keeps getting worse year after year, and that is with obesity and type 2 diabetes. There is a confluence of side effects that comes along with them. NASH is often referred to as the hepatic manifestation of metabolic syndrome. The pathogenesis of NASH is primarily associated with the metabolic system, as well as dysbiosis. A lot of that has to do with people who are chronically overweight or obese and its downstream effects.

There are some exceptions to that rule certainly, and there are several specific genetic mutations and other types of smaller orphan diseases that have nothing to do with metabolic syndrome that can lead to some of the same conditions. But the vast majority of people who have not only NASH but also type 2 diabetes are obese, so it is very closely tied to that.

On market potential, we have a very clear precedent in the growth of the market in treating NASH, not only in the U.S. but globally, and that is the market for type 2 diabetes. There are a number of products from many of the big pharma, as well as several of the large biotech companies. This is a space that continues to grow.

That experience with type 2 diabetes provides investors and senior management of these companies a clearer roadmap to the market potential. I say that because, although type 2 diabetes and NASH are quite different, they are closely tied. Not all patients who have that will have problems with their liver, but quite a few of them will.

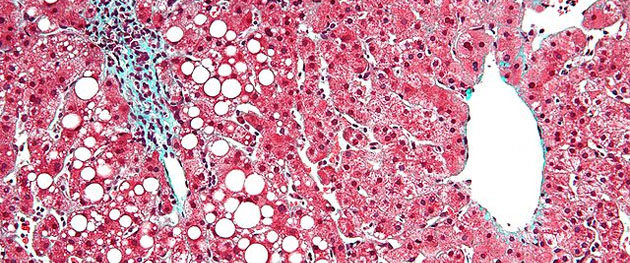

So to run through some of the numbers: NASH is a progressive disease; nonalcoholic fatty liver disease (NAFLD) precedes it. It starts with a fatty liver. That, as I said, predominantly starts with sustained obesity and lifestyle choices like diet and lack of exercise. NAFLD can progress. But before I move on, I should say that the group of people who can be diagnosed with fatty liver amazingly represents roughly a third of the U.S. population, so about 100 million people. This is an asymptomatic disease so most people go around for years not realizing that they have this condition. And quite a few of them also will never develop the disease, or the condition will never further develop.

TLSR: At that stage, NASH's progression can be stopped or even reversed with lifestyle changes such as weight loss and exercise, correct?

EA: There was a study published a couple of years ago (Vilar-Gomez E. et al. Gastroenterology Aug. 2015) that showed 90% of patients who are able to achieve at least a 10% reduction in body weight can self-resolve their NASH, which is an amazing find.

The problem is it's really hard to lose 10% of your body weight, but it's extremely difficult to maintain that loss. And then there's the 10% who, even with that substantial weight loss, don't self-resolve. But certainly, there's a lot that people can do to at least slow down the progression if they take lifestyle modification seriously.

TLSR: How does the disease progression continue?

EA: From that first group of about 100 million people, a much smaller subset will begin to have some injury to the liver as a result of the extra fat in the liver cells. That can start to cause inflammation and ultimately cause injury to the liver, called hepatocyte ballooning in the liver cells.

Once the disease has progressed to that point, a person now has NASH. It's a combination of the fatty liver and the inflammation that comes from that. NASH, in terms of the epidemiology in the U.S., is probably on the order of 15 to 20 million Americans, and that's both adults and adolescents.

Those who progress further start to have fibrosis or scarring of the liver. This begins to diminish the overall function of the organ. This is a clear sign that the disease is progressing. Those who have NASH and fibrosis of the liver number anywhere from 5 to 12 million people in the U.S.; it's a pretty large group.

This is really the focus of most of the trials that are ongoing now, both by small biotechs that are pure plays for NASH, as well as a lot of the larger companies that have programs for NASH and in some cases, like Gilead Sciences Inc. (GILD:NASDAQ) and Allergan Inc. (AGN:NYSE), have several programs with several different targets in mind. These include other big companies as well, like Novartis AG (NVS:NYSE), Bristol-Myers Squibb Co. (BMY:NYSE).

TLSR: At this point there is no medical treatment for NASH short of a liver transplant, right?

EA: Yes. And that obviously is only an option for those who are the most severe. Those patients who have fibrotic livers can continue to progress and get cirrhosis. And even there, some of those patients may continue to live for years without severe cirrhosis. There are different grades depending on the amount of the cirrhosis that has penetrated the organ. Beyond a certain point, patients are referred by their physicians to be placed on the liver transplant list. And that's obviously a very urgent situation.

The only available treatments right now other than lifestyle modification—change your diet, exercise more, try to lose weight and all of that—are some of the drugs that have been used for type 2 diabetes. I know that some endocrinologists will use pioglitazone, for example, but this is a very poor substitute for a disease that is very liver-centric. And of course, there's nothing FDA approved or indicated for NASH.

TLSR: Are investors still asking if NASH is a real disease? In your research, you comment that you continue to get queries asking if NASH could really be a condition that requires pharmacotherapy when approximately 25% of the world's population already has fatty liver disease.

EA: Yes, even just six months ago or so, at AASLD (American Association for the Study of Liver Diseases) last November, we spoke with a number of investors who were incredulous of the real underlying opportunity. I think part of that was, without understanding the disease and how rapidly its grown in the last few years, people just saw that Allergan paid a 500% up-front premium (1,800% including all biobucks) for Tobira Therapeutics Inc. (TBRA:NASDAQ), which had just reported that its lead compound missed its primary endpoint in a Phase 2b trial. Initially, Allergan got a lot of flak for that and I believe some viewed this as clear evidence that NASH is just a "red-hot" fad that would soon fade away. Clearly, in my view, nothing could be further from the truth (irrespective of the price paid for Tobira).

TLSR: What were some of the main takeaways from the NASH investor conference?

EA: One of them is that this is clearly a multifactorial disease, and this is continuing to become better understood over time. Two of the three panelists were also present at a panel I hosted last September. They mentioned to me that even just in the past six months, there has been a continuation of the understanding of the complete molecular evolution of the progression of disease.

A number of pathways are being looked at. Just as in cancer, there are likely ways that the body can go around or use other pathways if a particular target is being hit by a drug. So ultimately, as we're understanding that this is a multifactorial disease, I think most everyone is coming to the realization that there is likely no one drug alone that will suffice, even for some subset of patients.

Ultimately it's likely that combination therapy is going to be necessary, just as with hepatitis C and HIV before it—not only a combination of therapies but different combinations depending on the severity of the disease. Patients who are fibrotic and have clearly biopsy-proven NASH are the kinds of patients who are being looked at in trials today. Those will probably be the first to have FDA-approved treatments; that will be the first cohort.

But over time, I expect more and more drugs to come onto the market that will have different targets and will address different molecular pathways. So over time, I think these combinations will begin to progress to more subsets of the overall patient population, more and less severe subsets, both with NAFLD and NASH.

Another key takeaway is the diagnostic space is a limiting factor right now. Nobody wants to continue with the liver biopsy. It's invasive, it's painful, and at times it can be dangerous. So, there's a lot of activity from small and large companies to have the opportunity to look at a number of noninvasive diagnostics—imaging diagnostics as well as serum or blood-based tests—that could track and diagnose the disease without having to take a biopsy. Next year I'm planning to include a fair amount of time for the conference to also talk about the latest advances in diagnostics because this is an area that I think is going to go hand in hand with the therapeutics.

TLSR: Let's talk about some of the larger companies that have active NASH programs. Is there one company you want to start with?

EA: I'll start with Allergan. As I mentioned earlier, Allergan came into the space with a bit of a splash last fall with its acquisition of Tobira Therapeutics, a company that I had covered previously. Tobira has a compound called cenicriviroc (CVC). This is really the first drug that was able to show a meaningful benefit in fibrosis, a one-grade improvement in the fibrotic score in just 12 months. Before the results of this trial, called the CENTAUR trial, KOLs and everyone involved in the space assumed that it would take several years of treatment to see meaningful improvement. Allergan is now enrolling patients into its Phase 3 AURORA study of CVC with the primary endpoint of a one-point improvement in fibrosis stage, with no worsening of steatohepatitis, at 12 months, versus placebo.

Even more recently, Gilead's ASK1 inhibitor, selonsertib, has been able to show a meaningful fibrosis improvement in just six months, albeit in a small, open-label Phase 2 study. So, the field is moving quickly.

At the annual meeting of the European Association for the Study of the Liver (EASL) last month, Gilead reported that selonsertib in combination with its non-steroidal FXR agonist, GS-9674, produced greater reductions in hepatic steatosis and stronger expressions of genes associated with liver fibrosis, than either compound alone, in a preclinical mouse model of NASH. However, the big news out of Gilead last month was interim, 12-week data from its acetyl-CoA carboxylase (ACC) inhibitor, GS-0976, in an open-label, proof-of-concept study. Among the 10 patients evaluated, Gilead reported meaningful reductions in hepatic de novo lipogenesis (DNL), a 43% reduction in liver fat (as measured by MRI-PDFF), and even a statistically significant reduction in liver stiffness (a fibrosis surrogate), as measured by MRE. Gilead currently has two Phase 3 NASH trials ongoing.

A lot of the bigger companies are looking to have combinations in house. Allergan has CVC, but it also acquired a small company called Arkana out of the United Kingdom that has a non-bile acid farnesoid X receptor (FXR) agonist. So this is the same target as Intercept Pharmaceuticals Inc. (ICPT:NASDAQ) Ocaliva (obeticholic acid), but the difference is that it's non-bile acid.

This has become a hot topic for some of the companies that are looking at the FXR pathway because although it's still not proven, there is some evidence that points to the non-bile acid FXR having fewer side effects, such as the pruritus and the increase in cholesterol that have been seen with the bile acid FXR agonists like Intercept's Ocaliva.

Allergan has those two compounds and it just announced that it is collaborating with Novartis for a second FXR agonist. Clearly the combination here is something that it is looking for.

It's often forgotten that Allergan has also a DPP-4 inhibitor, which is a well-known target in the diabetes space, which it licensed from a Korean company that was approved last year in the Korean market.

All of those compounds are being viewed by Allergan as a way to form the bedrock of future combinations.

Another large cap company that presented new data at EASL is Bristol-Myers Squibb. It has a pegylated version of human fibroblast growth factor 21, or FGF21. This compound works through a separate pathway, one that is central to the regulation of metabolism. However, in 68 patients, at 16 weeks, their drug, BMS-986036, reduced liver fat by only 6.8% (by MRI-PDFF), which is clinically meaningful and statistically significant, but does not seem to compare to the results from Gilead's ACC inhibitor.

TLSR: Would you explain the metabolic pathways that companies are exploring?

EA: Two metabolic pathways are FXR agonists and the peroxisome proliferator-activated receptors (PPARs). The FXR pathway and the PPAR pathway have different effects.

FXR has been shown to have a pleiotropic effect, so broad effects in NASH, the ballooning and the inflammation but, also, fibrosis. What it lacks, though, is a stronger effect in the earlier metabolic effects. In fact, it actually makes the cholesterol a bit worse, and that's obviously a problem for this patient population that is often obese, has type 2 diabetes and will likely have cardiovascular conditions.

PPAR brings a very strong, robust and broad effect on the cardio-metabolic side effects that come as a consequence of the disease of NASH. The two pathways are actually viewed as complementary.

What's becoming clearer is a lot of molecular pathways are being pursued for clinical development. Ultimately, over time, as these become approved and come to the market, a lot of combinations will come, not only from drugs in house from one company, but, also, I believe there is likely going to be several deals once certain compounds get to Phase 3 and certainly by the time they're commercialized.

TLSR: Thank you, Ed. In part two of this interview, we will discuss small-caps in the NASH space.

Ed Arce is a managing director in equity research and a senior analyst covering companies in the biopharmaceuticals and specialty pharmaceuticals sectors for H.C. Wainwright & Co. Previously, Arce was a senior research analyst with ROTH Capital Partners. Prior to ROTH, he covered biotechnology, biopharmaceutical, specialty pharmaceutical and select medical device companies as an analyst at MLV & Co. Prior to MLV, Arce covered the biotechnology sector at Wedbush Securities, and large-cap pharmaceuticals at UBS Securities. Arce started his equity research career in 2005 as a research associate at First Albany Capital, covering specialty and generic pharmaceutical companies. He holds a Master of Science degree in finance (MSF) degree from Boston College, as well as a master's degree in business administration and a bachelor's degree in civil engineering, both from Florida International University. Arce is a board-licensed professional engineer, and a Level III CFA candidate.

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new interviews and articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor's fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Ed Arce: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this interview: None. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.