The most common cancers in the U.S. are hardly the most expensive to treat. More Americans come down with breast cancer and lung cancer than any other types of cancer. The worst cancer from a perspective of expense turns out to be bladder cancer that is only the 6th most prevalent form of disease.

There isn't much that can be done if you develop lung cancer. Rarely is the disease detected before it spreads to other organs; only 15% is discovered early. If lung cancer has spread, the 5 year survival rate is only 4% according to the American Lung Association. Lung cancer is cheap to treat because there isn't much you can do about it.

Bladder cancer on the other hand keeps recurring in 40–70% of the cases. The biggest cost isn't the cost of treatment; it's the cost of testing the patient again and again every six months to see if the cancer has come back.

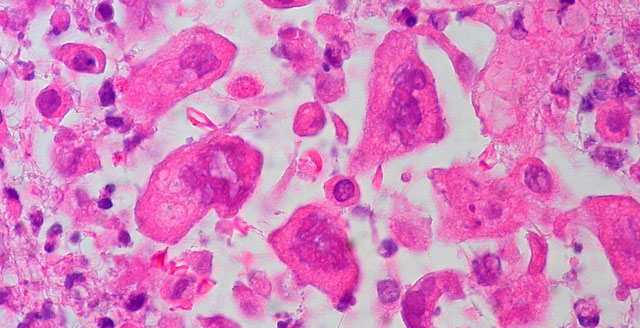

The treatment for bladder cancer once detected is to inject the patient a drug into the bladder that metabolizes in the area of cancer cells. That takes an hour and ties up the patient, the operating room and the surgeon. The surgeon cuts out what he can see. But for thirty years doctors have made endoscopes using white light the standard of detection. One of the big limitations is that the cancer is only seen if it protrudes higher than the bladder wall. And the surgeons want to leave as much of the bladder as they can so they often leave remnants of the cancer that reoccur.

The latest change in endoscopes was in 2010 when health care introduced the use of blue filters for a better image but still the doctor has to switch back and forth between the white light image and the blue filter image. The white light shows the entire bladder but not the cancer. The blue filter shows the cancer but not the bladder.

The biggest challenge facing the medical industry regarding bladder cancer is to come up with something that does a better job of detecting the cancer so the surgeon can remove all of it and cut down on the problem of reoccurrence. If bladder cancer didn't keep coming back, the cost of detecting could be a one-time expense, not a constant and continuing cost.

CEO Jim Hutchens heads Imagin Medical Inc. (IME:CSE). He founded two medical device companies in the past. The device his technical team has come up with makes use of the simultaneous acquisition of images from both the white light system and the fluorescence filter to blend them into a single actionable picture that puts the cancer into context. This system "sees" the cancer in 15 minutes as compared to one hour with prior devices and the optics are 100,000 times more sensitive.

This new device not only cuts down time in the operating room but also can be used in ordinary physicians' offices for whatever regular checkups are necessary. It's not evolutionary. It's revolutionary and highly disruptive.

Dr. Stavros Demos developed the concept while at the Lawrence Livermore National Laboratory in California. Dr. Demos collaborated with Dr. Ralph deVere White, an internationally recognized leading authority on bladder cancer, in a five-year program to determine feasibility. The final stages of development took place at the University of Rochester Laboratory for Laser Energetics in New York.

Imagin Medical only began trading in February. They did a capital raise in September to fund development of a working prototype that is expected by year-end. Clinical evaluations will begin in Q1 of 2017 with commercialization by mid-2018. The FDA presentation will begin in Q4 of 2016 with the application and clearance continuing into mid-2018.

According to the CDC, health care costs in the United States total over $3 trillion a year and the cost of care is $9,523 per capita (2014). Illness is big business and growing. The total national health care costs are 17.5% of GDP. Development of a new drug or a new medical device can easily be worth billions. On September 19 the FDA approved a new drug for treatment of the most common form of muscular dystrophy from Sarepta Therapeutics Inc. (SRPT:NASDAQ) and their shares soared by 74% in a day. That one-day move added $1.1 billion to their market cap. Sickness in the US is indeed big business.

Imagin Medical owns the right to a device five years in the planning and testing stage. They have under 40 million shares and trade for under $0.10 Canadian for a market cap of under $4 million. The device either does what they claim or it doesn't. Presuming they can raise the money to advance it to production and market it successfully they will have a very valuable medical device. If they fail utterly, the shares go to nothing. If they succeed, they go a lot higher.

Imagin is an advertiser and I am biased. It's an interesting story and concept and I hope they succeed. Their website is highly informative and I know they will be working hard to make sure the market understands their story. Do your own due diligence.

Imagin Medical Inc.

IME-C $0.095 (Sep 20, 2016)

IMEXF OTCBB 39.7 million shares

Imagin Medical website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. Imagin Medical Inc. is an advertiser. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.