The catalyst theory of investing in biotech stocks is all about the events that move shares in the public markets. Nobody wants dead money sitting in an account, but that's what you might be the case if you don't have a clear view of upcoming events that could make a stock jump in value.

Stock-moving milestones can be inflection points, where investors come in to buy, or, in the case of bad news, where they dump the stock. The downside can really be nasty because institutional investors tend to vote with their feet. Most are not activist investors who want to turn a company around. They want out so they can find another opportunity.

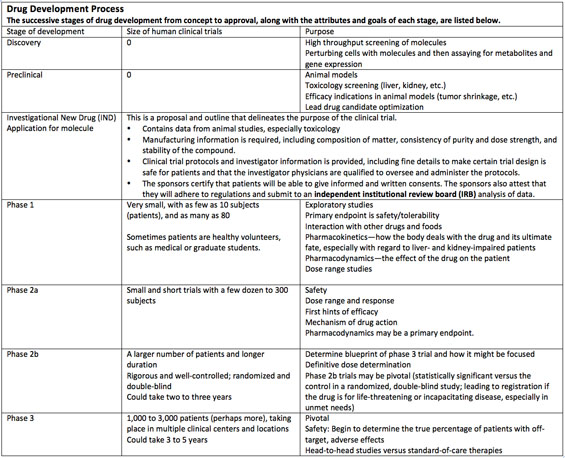

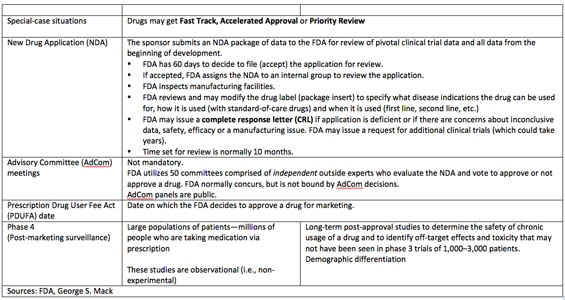

Events that move biotech stocks include phase 2 and phase 3 trial data, which tell investors if there is reason to place hope in a new drug. Phase 3 pivotal data are used in the company sponsor's new drug application (NDA), which the U.S. Food and Drug Administration (FDA) uses to make its final decision on drug approval.

Small companies are looking for any good news to share with investors. For these small caps, positive phase 1 data (conducted after the Investigational New Drug (IND) application for the molecule has been submitted), can be exciting. But it is generally not that thrilling for investors, who understand that completion of a phase 1 study is not momentous. A successful phase 1 completion only signals that a drug is ready for larger-scale testing, which could require another eight to 10 years of research and study. Another reality check: A drug entering a phase 1 study only has a one in 10 chance of getting through all the regulatory hurdles to approval.

Important trial data from phase 2 and phase 3 studies can produce extraordinary trading volume and price movement. Last year (2012) saw movement that more than doubled some share prices, while others lost nearly 70%. Trial results that tend to move shares are those that yield statistically significant data, which can only be derived from the randomized, double-blind experiments performed in phase 2b and phase 3 trials.

There are also the FDA's Advisory Committee (AdCom) meetings, in which independent expert panelists vote up or down on whether to recommend approval of a drug. Of course, AdComs produce volatility on heavy stock trading. Share price movement begins when briefing documents are disseminated to the public two days ahead of the AdCom meeting itself. But stocks could well turn around two days later, when the panel votes. AdComs are not required, but when products are truly new in their mechanisms of action or composition of matter, or when they are intended for chronic, lifetime use, AdComs are convened. The FDA can overrule the panel vote, but most often the agency follows the AdCom recommendation.

The final FDA decision to approve or not approve a new product occurs on the Prescription Drug User Fee Act (PDUFA) meeting date. The PDUFA date is the final step in the formal regulatory pathway.

Trial data, AdCom panel votes and PDUFAs make smaller company shares move dramatically. You might casually believe that a drug approval will bring about big purchases of company shares. But stocks sometimes sell off because the good news was baked into the share price after the results of the AdCom, or even from the release of pivotal phase 3 data. Investors may not envision any more near-term catalysts after approval.

Rest assured, if any news is bad, shares will plunge. Bad news can include the FDA placing an unexpected restriction, or perhaps a "black box warning" on the drug label.

The idea is to get ahead of the news with an informed opinion. If a second or confirmatory phase 3 trial is being performed, investors should how the trial design compares to the first trial's design. If it's the same, then the investor might expect the same good result. Investors will never be 100% of their picks, but small biotech companies present opportunities for big upside because the catalysts are, in many cases, binary events—up or down, good or bad.